Payment gateway providers are essential for online transactions, enabling businesses to securely process payments from customers. They act as intermediaries, facilitating the exchange of money between buyers and sellers. Different providers cater to various needs, from global enterprises to smaller regional businesses. This guide delves into the key aspects of payment gateway providers, covering security, transaction processing, integration, and more.

Understanding the nuances of different payment options, fees, and customer support is crucial for selecting the right provider. This guide provides a detailed overview, enabling businesses to make informed decisions about their payment processing solutions.

Introduction to Payment Gateway Providers

Payment gateway providers are crucial intermediaries in online transactions, facilitating secure and efficient processing of payments between merchants and customers. They act as a bridge, handling the complex technical aspects of accepting various payment methods, ensuring data security, and ultimately enabling businesses to seamlessly collect payments online.The role of a payment gateway provider is multifaceted. They handle the entire transaction process, from initial authorization to final settlement.

This includes verifying the customer’s payment information, processing the transaction, and settling funds with the merchant’s bank account. This streamlined approach frees merchants from the burden of managing payment infrastructure themselves, allowing them to focus on their core business operations.

Types of Payment Gateway Providers

Payment gateway providers can be categorized based on their geographic reach. Global providers offer services across multiple countries, while regional providers cater to specific regions or countries. This distinction influences the range of payment methods supported and the regulatory compliance requirements.

Key Features and Functionalities of a Payment Gateway

A typical payment gateway encompasses several key features and functionalities. These include secure transaction processing, support for diverse payment methods (credit cards, debit cards, digital wallets, etc.), robust fraud prevention mechanisms, detailed transaction reporting, and secure data encryption. These features are essential to ensure the security and efficiency of online transactions.

Comparison of Payment Gateway Providers

| Feature | Domestic Provider | International Provider |

|---|---|---|

| Payment Methods Supported | Primarily domestic payment options, such as credit cards issued by local banks, digital wallets used within the country. | Wider array of payment methods, encompassing international credit cards, debit cards, and global digital wallets. |

| Transaction Processing Speed | Generally faster due to localized processing networks. | Potentially slower due to international transaction routing and varying transaction times. |

| Regulatory Compliance | Adheres to local regulations and payment standards within the domestic market. | Needs to comply with international regulations, including cross-border payment standards and data privacy laws. |

| Currency Support | Primarily supports the local currency. | Supports a broader range of currencies, facilitating transactions involving international payments. |

| Customer Support | Customer support teams are often readily available and familiar with local market nuances. | Customer support teams might be spread across multiple time zones and may require more effort to understand specific local market requirements. |

Security Considerations

Payment gateway providers prioritize security to protect sensitive financial data. Robust security measures are crucial for building trust with customers and ensuring the integrity of transactions. This section details the security protocols, vulnerabilities, and best practices employed to safeguard online payments.

Security Protocols Employed by Payment Gateway Providers

Payment gateways leverage a combination of advanced security protocols to protect transactions. These protocols ensure the confidentiality and integrity of data exchanged between the merchant’s website and the payment processor. Secure Socket Layer (SSL) certificates, for example, encrypt data transmitted over the internet, preventing unauthorized access. Other commonly used protocols include Transport Layer Security (TLS), which is a more advanced version of SSL.

These protocols employ complex algorithms to scramble data, making it indecipherable to unauthorized parties. Furthermore, tokenization, a process of replacing sensitive credit card numbers with unique tokens, is widely adopted for enhanced security.

Importance of Data Encryption and Security Measures

Data encryption is paramount in protecting payment information. Encryption transforms readable data into an unreadable format, making it inaccessible to unauthorized individuals. Strong encryption algorithms, combined with robust security measures, such as firewalls and intrusion detection systems, are vital for preventing data breaches. Regular security audits and penetration testing are essential to identify and address potential vulnerabilities before they can be exploited.

The use of multi-factor authentication (MFA) adds another layer of security, requiring multiple verification steps to confirm the identity of the user.

Security Vulnerabilities Related to Payment Gateways

Payment gateways are susceptible to various security vulnerabilities. One significant concern is the risk of malicious software (malware) infecting a merchant’s system, potentially compromising sensitive payment data. SQL injection attacks, which exploit vulnerabilities in database queries, can also compromise payment gateway systems. Phishing attempts, where fraudulent websites mimic legitimate payment portals, pose a significant threat to users.

Man-in-the-middle attacks, where an attacker intercepts communication between the user and the payment gateway, are another concern. Data breaches, either through hacking or other malicious activity, are a critical vulnerability, potentially leading to the theft of customer data.

Best Practices for Secure Online Transactions

Secure online transactions require a multifaceted approach from both the merchant and the customer. Merchants should prioritize the use of strong passwords, regular security updates for their systems, and implement robust fraud detection mechanisms. Customers should be cautious about suspicious emails or websites, ensure they are using a secure connection (indicated by the padlock symbol in the browser address bar), and regularly monitor their accounts for any unauthorized activity.

Using reputable payment gateways, as opposed to unofficial or untrusted sources, significantly reduces the risk of financial fraud. Regularly reviewing and updating security protocols is essential for mitigating these vulnerabilities.

Table of Security Risks and Mitigation Strategies

| Security Risk | Mitigation Strategy |

|---|---|

| Malware Infection | Regular software updates, robust anti-virus software, and penetration testing. |

| SQL Injection Attacks | Using parameterized queries, input validation, and regular security audits. |

| Phishing Attempts | Educating users about phishing tactics, using secure communication channels, and implementing email filtering. |

| Man-in-the-Middle Attacks | Using secure protocols like TLS, validating certificate authenticity, and employing encryption techniques. |

| Data Breaches | Implementing robust access controls, regular security assessments, and data encryption. |

Transaction Processing: Payment Gateway Providers

Online payment transactions, a cornerstone of e-commerce, require seamless and secure processing. Understanding the intricacies of transaction processing, from initial authorization to final settlement, is crucial for both businesses and consumers. This section details the steps, associated costs, and processing speeds of various payment methods, enabling informed choices for both payment gateway providers and their clients.

Typical Online Payment Transaction Steps

Payment processing involves a series of interconnected steps, ensuring the security and efficiency of the transaction. A typical online payment transaction follows these steps:

- Customer Input: The customer enters their payment information, including card number, expiry date, and CVV, on the merchant’s website.

- Authorization Request: The payment gateway sends an authorization request to the card network (e.g., Visa, Mastercard) to verify the cardholder’s account and available funds.

- Verification and Approval: The card network validates the transaction against the cardholder’s account details and approves or declines the request.

- Capture: If authorized, the payment gateway captures the funds from the cardholder’s account.

- Settlement: The payment gateway transmits the funds to the merchant’s account.

Processing Times and Fees

Transaction processing times vary significantly based on the payment method and the payment gateway provider. Card networks like Visa and Mastercard typically have processing times of a few seconds to a few minutes. Other payment methods, such as e-wallets or bank transfers, may have longer processing times. Fees are also a crucial factor, impacting the profitability of online transactions.

- Card Payments: Visa and Mastercard transactions generally have faster processing times compared to other methods. Fees associated with these transactions are typically determined by the payment gateway provider and may vary based on transaction volume or other factors.

- E-wallets: E-wallet transactions, such as PayPal or Apple Pay, often have faster processing times than bank transfers. Fees may vary depending on the e-wallet provider and the specific transaction.

- Bank Transfers: Bank transfers are typically the slowest payment method. Processing times can range from a few hours to several business days. Fees, if any, are usually determined by the bank or the payment gateway provider.

Payment Gateway Provider Comparison

Different payment gateway providers may offer varying processing speeds for different payment methods. Factors such as infrastructure, network connectivity, and transaction volume handling capacity influence the speed of transactions. Some providers may specialize in faster processing times for certain types of transactions, while others prioritize security and compliance.

Payment Methods Supported by Payment Gateways

Payment gateways facilitate a diverse range of payment methods, catering to various customer preferences and global payment systems. Popular options include credit cards, debit cards, digital wallets, bank transfers, and mobile payments. The selection of supported payment methods by a payment gateway directly impacts its market reach and customer base.

Payment Methods and Processing Speeds

| Payment Method | Typical Processing Speed |

|---|---|

| Credit Cards (Visa/Mastercard) | Typically 1-3 seconds |

| Debit Cards | Similar to Credit Cards, but can vary slightly |

| E-wallets (PayPal, Apple Pay) | Generally 1-5 seconds |

| Bank Transfers | Several hours to several business days |

| Mobile Payments (e.g., Alipay, WeChat Pay) | Typically 1-3 seconds |

Integration and Setup

Integrating a payment gateway into your e-commerce platform is a crucial step. Proper integration ensures seamless transactions, minimizes errors, and protects sensitive financial data. Careful planning and adherence to the gateway’s technical specifications are vital for a smooth and secure implementation.The integration process involves several key steps, from initial setup to ongoing maintenance. Understanding the technical requirements and selecting the appropriate API options are critical for success.

This section details the process and provides essential information for successful integration.

Integration Process Overview

The process of integrating a payment gateway typically involves several steps, beginning with account setup and concluding with testing and deployment. Thorough documentation and communication with the payment gateway provider are crucial for a successful integration. This includes understanding their specific procedures, and adhering to their security guidelines.

Technical Requirements and Specifications

Payment gateway integrations require specific technical specifications to ensure compatibility and security. These specifications often include details on supported programming languages, data formats, and security protocols. For instance, the gateway might require specific encryption methods for secure data transmission. Understanding these requirements is essential for smooth integration and compliance with security standards.

Setting Up a Payment Gateway for a Website

Setting up a payment gateway for a website involves configuring the gateway’s API keys and credentials, and integrating the necessary payment forms and buttons into the website’s checkout process. Properly configuring these components is crucial for secure and efficient transactions. The integration process often requires technical expertise, especially if the website uses custom code.

API Options for Payment Gateway Integration

Payment gateways typically offer various API options for integration. These APIs provide standardized interfaces for interacting with the gateway, allowing developers to build custom solutions. REST APIs are a common choice for their flexibility and ease of use. Other options include SOAP APIs, which offer more structured communication but may require more complex setup.

Comparison of Integration Methods

| Integration Method | Pros | Cons |

|---|---|---|

| Direct Integration (Custom Code) | Maximum control over the checkout process, potential for customized UI. | Requires significant development resources, increased risk of errors if not carefully implemented, more challenging to maintain. |

| Payment Gateway SDKs | Simplified integration, reduces development time, often includes example code and documentation. | Limited customization options, potential for vendor lock-in if the SDK is not well-supported. |

| API Integration (REST or SOAP) | Flexible integration options, widely supported by various programming languages. | Requires more technical expertise, potentially more complex setup than SDKs. |

Different integration methods offer varying degrees of control and complexity. The optimal choice depends on the specific needs and resources of the e-commerce platform. Careful consideration of the pros and cons of each method is essential. A balance between flexibility and ease of implementation should be sought.

Payment Options and Features

Payment gateways offer a diverse array of payment options to cater to various customer needs and preferences. Understanding these options and their associated features is crucial for businesses seeking to optimize their transaction processing capabilities and enhance customer experience. Different gateways prioritize specific payment methods, often reflecting the target market or geographic region they serve. This section delves into the common payment options, their benefits, mobile integration, and advanced features like recurring billing.

Common Payment Options

Various payment gateways support a wide range of payment methods, each with its own set of advantages. This section Artikels some of the most prevalent options and their typical applications.

- Credit Cards: Widely accepted globally, credit cards remain a dominant payment method. They provide convenience and security for consumers, and gateways facilitate secure processing of transactions using standardized protocols. This method is often preferred for larger purchases.

- Debit Cards: Similar to credit cards in terms of functionality, debit cards directly deduct funds from the customer’s bank account. This option is frequently chosen for its speed and convenience. Debit card transactions often require less extensive verification compared to credit cards.

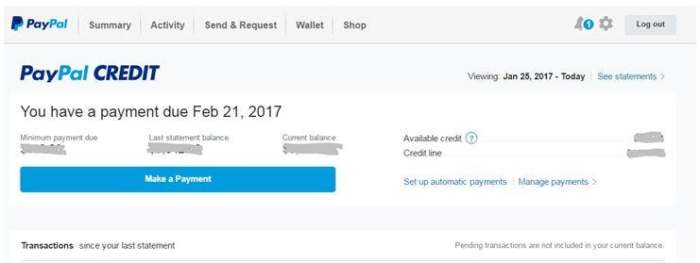

- Digital Wallets: Digital wallets like PayPal, Apple Pay, and Google Pay offer a streamlined experience for customers. They store payment information securely and allow for quick transactions. Integration with digital wallets can significantly enhance the customer journey by providing a convenient and accessible option.

- Bank Transfers: A traditional payment method, bank transfers allow customers to transfer funds directly from their bank account to the merchant’s account. While slower than other options, bank transfers offer an alternative for customers who prefer this method. Security protocols are important to ensure the integrity of funds during the transfer.

- E-Checks: E-checks function similarly to paper checks but are processed electronically. They are often a popular choice for businesses that already utilize paper checks and seek to transition to a digital format.

Mobile Payment Integration

Mobile payment integration with payment gateways is increasingly important for businesses aiming to offer a seamless customer experience. The integration allows for mobile-first transactions, enabling customers to make purchases through their smartphones or tablets.

- Enhanced User Experience: Mobile payment integration creates a streamlined and convenient experience for customers, often leading to increased sales and customer satisfaction.

- Accessibility: Mobile payment options broaden access to products and services, particularly for customers who prefer to shop on the go or may not have access to traditional payment methods.

- Security Considerations: Implementing secure mobile payment gateways is paramount to protect customer data and financial information. Payment gateways typically utilize advanced encryption and authentication methods to ensure transactions are secure.

Recurring Billing

Recurring billing is a valuable feature for businesses offering subscriptions or memberships. This feature automates recurring payments, making it a critical aspect of subscription management.

- Subscription Management: Recurring billing simplifies the management of subscriptions, enabling businesses to easily collect payments on a regular schedule. This streamlines the process and minimizes manual intervention.

- Customer Retention: Recurring billing encourages customer retention by automating payments, making it easier for customers to maintain their subscriptions. The ease of use and automation of the process are key benefits.

- Examples of Payment Gateways with Recurring Billing: Several payment gateways offer robust recurring billing features, allowing businesses to set up and manage subscriptions effectively. Stripe, for instance, is known for its strong recurring billing support.

Comparison of Payment Options

The following table provides a comparative overview of payment options offered by different payment gateway providers. This overview helps businesses evaluate the most suitable options for their specific needs and target markets.

| Payment Gateway Provider | Credit Cards | Debit Cards | Digital Wallets | Bank Transfers | E-Checks |

|---|---|---|---|---|---|

| Provider A | Yes | Yes | Yes | Yes | No |

| Provider B | Yes | Yes | Yes | Yes | Yes |

| Provider C | Yes | Yes | Yes | No | Yes |

Fees and Charges

Payment gateway providers charge various fees to facilitate online transactions. Understanding these fees is crucial for businesses to accurately project their operational costs and optimize their pricing strategies. This section delves into the different types of fees, their calculation methods, and how to minimize overall transaction costs.Different payment gateway providers employ diverse pricing models, impacting businesses’ bottom lines.

Payment gateway providers are crucial for online transactions. They handle the complex process of processing payments securely, and a reliable provider is essential. For instance, the S25 Edge S25 Edge device might need a specific gateway to facilitate transactions. Ultimately, the right payment gateway provider is key for any business looking to operate smoothly online.

Comparing these models is essential for selecting a provider that aligns with specific needs and budget constraints.

Types of Fees

Payment gateway fees encompass a range of charges. These include transaction fees, which are levied for each successful transaction; monthly subscription fees, which are recurring charges for access to the platform; and potentially, setup fees for initial account creation. Some providers may also charge interchange fees, which represent the cost of processing the transaction through the acquiring bank’s network.

Furthermore, some providers may assess additional fees for specific payment methods, such as international transactions or high-value transactions.

Transaction Fee Calculation Methods

Transaction fees are calculated using various methods. A common approach is a percentage-based fee on the transaction amount. For example, a 2.9% + $0.30 fee structure means a fee of 2.9% of the transaction value plus a fixed $0.30 charge. Other models involve tiered pricing, where the fee percentage decreases as the transaction volume increases. A flat rate per transaction is another possibility.

It’s important to carefully analyze the fee structure to determine the most cost-effective option for your business.

Comparison of Pricing Models

Payment gateway providers utilize different pricing models. Some offer tiered pricing plans, offering discounts based on transaction volume. Others may have flat-rate models that charge a set fee per transaction, irrespective of volume. Some providers might incorporate a combination of both percentage and fixed fees. It’s crucial to compare the pricing models of different providers to determine which aligns best with your business’s expected transaction volume and revenue structure.

This comparison should consider factors beyond the basic fee structure, such as available features, support options, and integration complexities.

Minimizing Transaction Costs

Businesses can employ several strategies to minimize transaction costs. Choosing a payment gateway with a favorable fee structure, based on transaction volume projections, is essential. Optimizing the checkout process for a smoother customer experience can increase conversion rates and reduce transaction abandonment. Also, careful consideration of the types of payment methods offered can impact transaction costs. For example, utilizing domestic payment options over international ones can sometimes lower costs.

Fee Structure Comparison Table

The following table illustrates different fee structures across several payment gateway providers, showcasing variations in transaction fees. Note that these are hypothetical examples and actual fees may vary.

| Provider | Transaction Fee Structure | Monthly Fee | Setup Fee |

|---|---|---|---|

| Provider A | 2.9% + $0.30 per transaction | $29.99 | $99.99 |

| Provider B | 2.5% + $0.25 per transaction (for transactions over $1000) | $49.99 | Free |

| Provider C | Flat rate of $0.50 per transaction | $99.99 | $149.99 |

Customer Support and Service

A robust customer support system is critical for payment gateway providers. Reliable assistance ensures smooth transactions, mitigates potential issues, and fosters customer satisfaction, ultimately impacting the provider’s reputation and user experience. Effective support channels allow users to quickly resolve problems, which can prevent costly delays and financial losses.

Importance of Customer Support

Customer support is vital for maintaining a positive user experience and ensuring the smooth operation of payment gateways. Prompt and effective assistance helps resolve issues, builds trust, and encourages continued use of the service. This direct engagement with users allows providers to gather valuable feedback and identify potential areas for improvement in their services. By providing timely support, payment gateways demonstrate a commitment to customer satisfaction and can prevent potential negative reviews or escalations.

Methods of Customer Support

Various methods of customer support are utilized by payment gateway providers to cater to diverse user needs. These range from easily accessible FAQs and online documentation to phone support and email correspondence. A multi-channel approach, encompassing self-service options and dedicated support staff, is often employed to address user queries and concerns efficiently.

Contacting Support for Assistance

Most payment gateway providers have dedicated support channels Artikeld on their websites. Users can often find contact information, FAQs, and troubleshooting guides readily available. These resources are often categorized to guide users towards the most relevant assistance for their specific issue. Utilizing these resources efficiently allows users to find solutions quickly and minimizes the need for direct interaction with support staff.

Troubleshooting Common Payment Gateway Issues

Common issues often revolve around transaction failures, authorization errors, and integration problems. Users can often resolve these issues by carefully reviewing the provider’s documentation, using troubleshooting guides, and checking transaction logs for errors. Providers frequently offer step-by-step guides on resolving these issues, which can be invaluable for users seeking independent solutions. For more complex problems, dedicated support staff is available to provide personalized assistance.

Support Channel Availability

| Support Channel | Availability ||—|—|| Email Support | Typically 24/7 || Phone Support | Usually limited hours, often during business days || Live Chat | Often available during business hours || FAQs/Knowledge Base | Accessible 24/7 || Online Documentation | Accessible 24/7 |

Scalability and Reliability

Choosing a payment gateway is crucial for businesses of all sizes, but especially for those anticipating growth. A robust payment gateway should adapt to increasing transaction volumes and maintain consistent performance, even during peak periods. Reliability is paramount; downtime can lead to significant revenue loss and damage customer trust.

Choosing a Payment Gateway for a Growing Business

A growing business needs a payment gateway capable of handling increasing transaction volumes without performance issues. Factors to consider include the gateway’s processing capacity, transaction speed, and ability to accommodate future growth. Look for providers with clear scalability metrics and a history of handling high transaction loads. In addition, investigate the gateway’s API (Application Programming Interface) for ease of integration and future expansion.

A well-documented API enables smooth adjustments as your business scales.

Scalability Features of Different Payment Gateway Providers

Different providers offer varying scalability features. Some may excel in handling high-volume transactions, while others might focus on specific industry niches. Payment gateways with robust infrastructure and a global reach are typically better equipped to handle large transaction volumes. Features like redundant servers, geographically distributed data centers, and high-bandwidth connections contribute to scalability. Additionally, consider the gateway’s ability to handle various payment types and methods, as this flexibility is crucial for adapting to evolving customer preferences.

Importance of Reliability and Uptime for Online Transactions

Reliability and uptime are critical for online transactions. Downtime translates directly into lost sales, frustrated customers, and a damaged reputation. Customers expect seamless and instantaneous payment processing, and any interruption can erode trust. High uptime ensures consistent service, allowing businesses to maintain a positive customer experience. A reliable gateway builds customer confidence and fosters loyalty.

Consider a gateway’s uptime history and disaster recovery plan.

Evaluating the Reliability of a Payment Gateway

Evaluating a payment gateway’s reliability requires a multi-faceted approach. Firstly, examine their uptime history, looking for consistent availability and minimal downtime. Secondly, consider the provider’s infrastructure and security measures. A well-established payment processor with a strong security track record will typically exhibit better reliability. Thirdly, review customer testimonials and feedback to understand their experiences with the gateway.

Finally, seek clear communication channels for addressing issues or concerns promptly. A well-structured support system contributes to the overall reliability.

Scalability and Reliability Ratings of Different Providers

A definitive ranking of payment gateway providers based on scalability and reliability is challenging due to varying business models and the dynamic nature of the industry. However, a comparative analysis based on publicly available information is possible.

| Provider | Scalability Rating (1-5, 5 being highest) | Reliability Rating (1-5, 5 being highest) | Comments |

|---|---|---|---|

| Provider A | 4 | 4 | Known for handling high-volume transactions, strong uptime history. |

| Provider B | 3 | 5 | Focuses on niche markets, exceptional reliability despite lower volume capacity. |

| Provider C | 2 | 3 | Good for smaller businesses, but scalability may be limited. |

| Provider D | 5 | 4 | Excellent scalability features, good uptime, but potentially higher fees. |

| Provider E | 4 | 3 | Solid provider, but reliability might need more scrutiny. |

Note: Ratings are based on publicly available information and general industry perception. Individual experiences may vary. Thorough research and analysis are recommended before choosing a payment gateway.

Compliance and Regulations

Payment gateway providers operate within a complex regulatory landscape. Compliance with these regulations is paramount, ensuring the security and integrity of financial transactions. Failure to adhere to these standards can result in significant penalties and damage to a company’s reputation.

Compliance Requirements for Payment Gateways

Payment gateways must meet stringent requirements to ensure secure and compliant transactions. These requirements encompass various aspects, including data security, transaction authorization, and reporting. Adhering to these regulations is crucial for maintaining customer trust and avoiding legal repercussions.

Role of Regulations in the Payment Industry

Regulations play a critical role in maintaining the stability and integrity of the payment industry. They protect consumers from fraudulent activities, ensure transparency in transactions, and safeguard the financial system from risks. Regulations foster trust in the payment ecosystem, encouraging participation and facilitating smooth transactions.

Ensuring Compliance with Regulations, Payment gateway providers

Maintaining compliance requires a proactive approach. This involves staying informed about evolving regulations, implementing robust security measures, and regularly auditing processes. Continuous monitoring and adaptation to new guidelines are essential to maintain compliance in a dynamic regulatory environment. A dedicated compliance team, thorough documentation, and a clear understanding of regulatory requirements are also key elements.

Regulatory Bodies Overseeing Payment Gateways

Various regulatory bodies oversee payment gateways, each with specific jurisdictions and responsibilities. These bodies enforce regulations, investigate potential violations, and provide guidance to industry participants. Understanding the roles and responsibilities of these organizations is vital for navigating the regulatory landscape effectively. Examples include central banks, financial regulators, and industry-specific bodies.

Payment gateway providers are crucial for smooth online transactions. They handle the complexities of processing payments, ensuring secure transactions for various businesses. This is especially important when considering the growing market for accessories like Hobo Bags , where online purchases are common. Ultimately, robust payment gateways are essential for the success of any e-commerce operation.

Table of Relevant Compliance Regulations and Requirements

| Regulatory Body | Relevant Regulations | Key Requirements |

|---|---|---|

| Federal Reserve (USA) | Payment Card Industry Data Security Standard (PCI DSS) | Implementing strong security measures, including encryption, access controls, and regular security audits. Maintaining detailed transaction logs and promptly reporting suspicious activities. |

| European Central Bank (ECB) | PSD2 (Payment Services Directive 2) | Adhering to stringent data security standards, providing transparent information to consumers, and ensuring secure authentication methods. Facilitating secure access to account information. |

| Reserve Bank of India (RBI) | National Payments Corporation of India (NPCI) guidelines | Adhering to regulations concerning payment systems, including digital payments, UPI, and mobile wallets. Ensuring compliance with data security protocols and maintaining secure transaction processing systems. |

| Other Regional Regulators | Specific local regulations | Meeting specific regulations of each country or region, such as those regarding anti-money laundering (AML) and know-your-customer (KYC) compliance. Implementing robust systems for compliance with regional legislation. |

International Payments

International payments present unique challenges compared to domestic transactions. Variations in currency exchange rates, regulations, and payment systems across countries create complexities that require careful consideration. Navigating these intricacies is crucial for businesses operating globally, as it directly impacts profitability and efficiency.

International Payment Options

Different payment methods cater to diverse international transaction needs. The optimal choice depends on factors like the recipient’s location, transaction amount, and desired speed.

- Wire Transfers:

- A traditional method, wire transfers involve transferring funds electronically between banks. They are often preferred for large sums, offering a direct, traceable method. However, wire transfers can be slow, with processing times often spanning days.

- International Money Orders:

- Issued by postal services or financial institutions, these orders are useful for smaller transactions. They provide a relatively secure and traceable way to send money internationally.

- International Cards (e.g., Credit Cards, Debit Cards):

- Credit cards are widely accepted globally, offering convenience. However, international transactions may incur higher fees and foreign exchange markup.

- Digital Payment Systems:

- Platforms like PayPal and Western Union offer convenient options for cross-border transactions, with varying processing times and fees. They provide a user-friendly experience, but fees and transaction limits might apply.

International Payment Procedures

The procedures for international payments are multifaceted and differ based on the chosen method. Businesses and individuals should adhere to specific guidelines for each payment option.

- Beneficiary Information:

- Accuracy in providing the recipient’s bank details, including account number, SWIFT code, and bank name, is paramount. Errors can lead to delays or failed transactions.

- Currency Conversion and Exchange Rates:

- Exchange rates fluctuate, impacting the final amount received by the recipient. The chosen payment method may apply its own exchange rate or utilize the market rate.

- Documentation Requirements:

- Documentation requirements vary according to the payment method and the countries involved. Often, supporting documents are needed, such as invoices or commercial documents.

Currency Conversion and Exchange Rate Implications

Understanding the impact of currency conversion and exchange rates is essential. Fluctuations can significantly alter the transaction’s value.

Exchange rate fluctuations can have a significant impact on international transactions, potentially leading to losses or unexpected gains.

- Real-time exchange rates:

- These rates change constantly, reflecting market forces. Payment gateways or financial institutions use these real-time rates for conversions, affecting the final transaction amount.

- Exchange rate markup:

- Payment gateways or financial institutions might add a markup to the exchange rate, influencing the effective exchange rate for the transaction.

International Payment Options Comparison

The following table compares different international payment options based on fees and processing time.

| Payment Method | Processing Time (Typical) | Typical Fees | Security |

|---|---|---|---|

| Wire Transfer | 3-5 business days | Low to Moderate | High |

| International Money Order | 1-3 business days | Moderate | Medium |

| International Cards | Instant to 1-2 business days | Moderate to High (depending on card type and transaction amount) | Medium |

| Digital Payment Systems | Instant to 1-2 business days | Moderate to High (depending on system and transaction amount) | Medium to High |

Emerging Trends

The payment gateway industry is constantly evolving, driven by technological advancements and shifting consumer expectations. Staying ahead of these trends is crucial for providers to maintain competitiveness and deliver seamless experiences for their clients. This section explores key emerging trends shaping the future of online payments.

Impact of New Technologies

New technologies are significantly impacting payment processing. Mobile wallets, biometric authentication, and AI-powered fraud detection are transforming how transactions are conducted and secured. These technologies are not only enhancing convenience for consumers but also offering improved security and efficiency for businesses. This evolution is driven by a desire for faster, more secure, and user-friendly payment experiences.

Adapting to New Technologies

Payment gateways are adapting to these technological shifts by integrating mobile payment platforms, incorporating biometric authentication methods, and leveraging AI for fraud prevention. For instance, many gateways now support Apple Pay, Google Pay, and other mobile payment systems. This adaptability is crucial for staying relevant in a dynamic market. This integration not only reflects the changing needs of customers but also allows for greater flexibility in transaction processing.

Future Developments

The future of payment gateways promises even more innovative solutions. Expect to see a rise in decentralized payment systems, enhanced use of blockchain technology, and increasingly sophisticated fraud prevention mechanisms. The integration of AI and machine learning will play a pivotal role in optimizing transaction processing and reducing fraudulent activities. Real-world examples of this include the growing popularity of cryptocurrencies and the increasing use of AI in risk assessment.

New Trends in Payment Gateways

The payment gateway industry is embracing a range of emerging trends.

- Decentralized Payment Systems: These systems offer greater control and transparency to users by eliminating intermediaries in the transaction process. Examples of this include cryptocurrencies and stablecoins, which are becoming more widely accepted as payment methods.

- Enhanced Security Measures: Biometric authentication, such as fingerprint or facial recognition, is becoming increasingly prevalent. This heightened security not only protects consumers but also strengthens the integrity of the entire payment ecosystem.

- AI-Powered Fraud Detection: Artificial intelligence is being used to identify and prevent fraudulent transactions with greater accuracy and speed. This reduces the risk of financial loss for both consumers and businesses.

- Blockchain Technology Integration: Blockchain technology is being explored for its potential to enhance transparency and security in transaction processing. This technology is capable of creating more secure and immutable transaction records.

- Integration with IoT Devices: Payment gateways are being designed to support payments through various Internet of Things (IoT) devices. This allows for seamless transactions across diverse platforms.

Closing Notes

In conclusion, choosing the right payment gateway provider is a critical decision for any online business. This comprehensive guide has explored the essential factors to consider, from security and transaction processing to integration, fees, and customer support. By carefully evaluating these aspects, businesses can select a provider that meets their specific needs and ensures smooth, secure, and reliable online transactions.

The future of payment processing is dynamic and evolving, requiring businesses to stay informed about emerging trends and technologies to maintain a competitive edge.

FAQ Resource

What are the common security vulnerabilities related to payment gateways?

Common vulnerabilities include insufficient encryption, weak passwords, and lack of multi-factor authentication. Improperly configured payment forms or gateways can also leave sensitive data exposed.

What are the different types of fees charged by payment gateway providers?

Typical fees include transaction fees, monthly fees, and potentially setup or maintenance fees. The specific fee structure varies between providers and payment methods.

How can I minimize transaction costs?

Careful consideration of payment options, understanding provider fee structures, and negotiating contracts with providers can help minimize transaction costs. Optimizing transaction processes can also contribute to lower fees.

What are some emerging trends in the payment gateway industry?

Emerging trends include increased use of mobile payments, greater emphasis on security, and the integration of AI and machine learning for fraud detection.